Table of Content

To gross up payments, lenders usually use a factor of 1.25, or 125 percent of the benefit amount. As such, a monthly $1,000 social security check becomes $1,250 for qualifying purposes. People who apply for disability benefits because they can't work sometimes go into debt while waiting for their application to be approved.

Although you might face additional challenges, buying a home on SSI is still possible. Lenders look at your income and credit score, just like they would with any other loan applicant. But even if your credit score and income aren’t up to par, there are programs in place to help you get into a home. You can use Zillow to quickly find a lender who’s licensed to work in your area. Fortunately, there are several programs that can help people who are receiving disability benefits buy a house, which we'll explore below.

The Income You Can Use To Land That Mortgage

Typically, the SSI system restricts people in how much property they can own. So, while SSI beneficiaries can own a primary residence and the land it stands on, additional property may jeopardize their ability to access full SSI benefits. And if their countable resources exceed a specified amount, they will end up progressively losing those benefits until they disappear altogether.

If you are an Advocate, Attorney, or Third Party Representative and you are helping someone prepare an online Social Security benefit application, there are some things you should know. Are unable to work because of a medical condition that is expected to last at least 12 months or result in death. Do not delay applying for benefits because you do not have all the documents. This includes medical records, doctors' reports, and recent test results. Name, address, and phone number of someone we can contact who knows about your medical conditions and can help with your application. We process your application and forward your case to the Disability Determination Services office in your state.

Fannie Mae home loans for disabled individuals

By providing this along with a monthly bank statement, it will prove the borrower’s income. Additionally, disability income received in the borrower’s name for dependents may be used for qualifying income. In most cases, the borrower must prove the child is a dependent. Since the income is not directly for the disabled borrower, the age of the child must be proven. This is to show the dependent income should continue 3+ years.

With a limited monthly income, it can seem incredibly difficult to save for a home while also covering ongoing household needs. According to 2017 Zillow data, 68 percent of renters cited saving for a down payment as the biggest hurdle to buying a home. SSI serves as a stipend resource for people with limited income who have a physical disability, and are 65 or older. These benefits are paid out monthly at the current rate of $735 for an individual and $1,103 for a couple, as of January 2017. Imposing different terms or conditions of a mortgage loan, such as interest rates or fees, for those who rely on disability income. For someone receiving a large amount of SSDI, qualifying for a mortgage is less likely to be a problem.

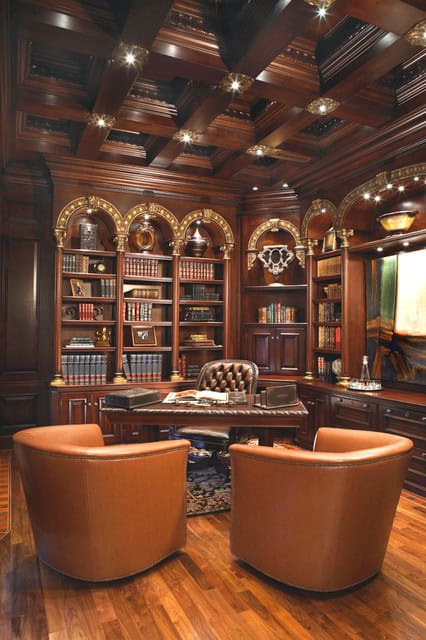

Las Vegas Custom Loans

These assistance programs will typically be offered by your state’s Housing Finance Agency or county and local governments. These programs allow parents to buy the home as an “owner-occupied residence” even though they won’t live in it. This means they can get better mortgage rates and loan terms than they would if they bought the property as a second home. For example, a parent or sibling with strong credit and high income could be included on their disabled family member’s mortgage. Just keep in mind that the total income being counted toward your mortgage qualification must remain below HomeReady income limits.

You can learn more and find your local Rebuilding Together Affiliate here. Habitat for Humanity builds accessible homes as defined by the Americans with Disabilities Act . It can also provide affordable mortgages to those approved for its program. For eligible homeowners, USDA Housing Repair Grant can offer a grant of up to $10,000 or a loan of up to $40,000 to pay for home repairs and upgrades. Loans are repayable over 20 years and have a fixed interest rate of just 1 percent. Grants and loans can also be combined for total assistance of up to $50,000.

Can I receive VA disability for Burn Pit exposure?

Most lenders consider a FICO® Score of 740 or higher to be an excellent one. Buyers with moderate incomes who don’t qualify for USDA’s subsidized program can still access a USDA Rural Housing loan. It has looser guidelines, but still allows zero down payment and offers below-market mortgage rates.

Here at All Western Mortgage we deal with a wide variety of lenders. We know their policies back to front, as well as the hidden catches and potential problems you might face. Federal law prohibits lenders from discriminating against borrowers based on age, disability and the form of income used to qualify for a loan. This protection helps elderly and disabled borrowers who live off of social security benefits buy a house. As long as your credit and property meet the lender's guidelines, and you receive enough benefits to cover the housing payment, you can get a loan. If the individual’s credit score is good enough to qualify for a loan, they may use the social security disability benefits as their source of income.

Being disabled isn't something that you ask for and whether you have been disabled all of your life or you have become disabled by an injury, fulfilling your dreams of buying a house can still be a reality. The federal Fair Housing Act protects your rights against being denied a mortgage loan because of your disability. You are also protected from discrimination by the Americans With Disabilities Act. To qualify, you must be retired or in the process of retiring and pass a criminal and credit background check. You can request assistance and find more veteran housing resources on the Homes for Our Troops website.

Award letters, pay stubs, settlement agreements, or other proof of any temporary or permanent workers' compensation-type benefits you received. Processing time for disability applications vary depending on the nature of the disability, necessary medical evidence or examinations, and applicable quality reviews. Do not forget other forms of nontaxable income which may be increased in the same way. These include child support, VA disability, pastoral housing allowance, railroad retirement, foster care, some levels of social security, and more.

Having late payments or substantial debt can have a negative impact on their credit scores. The USDA offers loans to low-income individuals to purchase or construct homes in rural areas. USDA loans are subsidized, meaning the department helps cover a portion of the mortgage payments for part of the loan term.

The Monthly Benefit Amount that you receive from your Social Security Disability benefits will play a direct role in the approval of a loan from Fannie Mae, despite having a less than desirable credit rating. Another way Fannie Mae can help when you qualify for this program is by incorporating the cost of improvements to the home you are buying when they are specifically designed for your disability needs. If you are disabled and looking to purchase a home, you should have no problem getting a mortgage loan.